In Belgium, personal income tax is calculated using tax brackets. This means that the more you earn, the higher the percentage applied to the additional part of your income.

In this article, you learn which tax brackets apply in 2026, how the calculation works and which factors determine whether you ultimately pay more or less tax.

What does “assessment year 2026” mean?

In Belgium, taxes are always applied to income earned in the previous year.

- Income 2025 refers to what you earned during the calendar year 2025, such as salary, profit or rental income.

- Assessment year 2026 is the year in which those incomes are declared and taxed.

In other words: what you earned in 2025 (your salary, profits, additional income, etc.) will have to be declared in 2026.

Tip from an accountant

A common misunderstanding is that the assessment year 2027 refers to the money you earned in 2026.

The tax brackets in 2026

Belgian personal income tax works with four brackets.

Your income is taxed progressively according to the following rates:

| Taxable income | Rate |

| €0 – €16,320 | 25% |

| €16,320 – €28,800 | 40% |

| €28,800 – €49,840 | 45% |

| Above €49,840 | 50% |

👉 You do not pay 50% on your entire income once you exceed €49,840. Only the part above that threshold is taxed at 50%. In addition, everyone is entitled to a tax-free allowance of €10,910 for assessment year 2026. No tax is due on that part of your income. If you have children or other dependants, this allowance increases.

What is the tax-free allowance?

In Belgium, the tax-free allowance differs per person. It is the part of your income that is not taxed and depends on your personal situation. Some important factors are listed below.

- Number of dependent children

- Each dependent child increases the tax-free allowance.

- Age or other circumstances

- An increase applies once you are older than 65.

- Other deductions may apply, for example in cases of disability or informal care.

The term “tax-free allowance” can be misleading. You do not actually pay 0% tax on the first €10,910. Instead, you receive a tax reduction equal to 25% of your tax-free allowance. For example, €10,910 × 25% = €2,727.50.

How do you calculate your tax in practice?

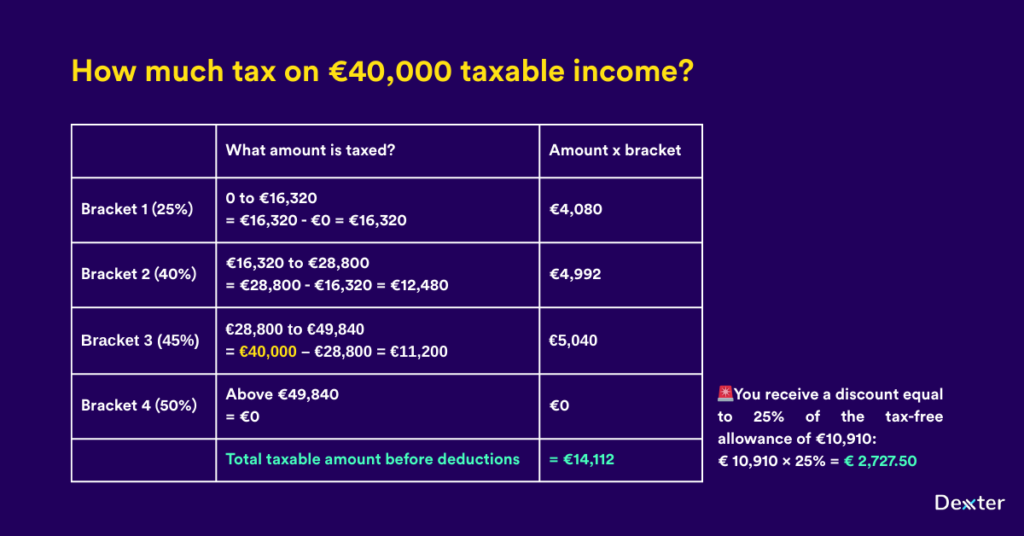

Let us take an example. You have a taxable income of €40,000 in income year 2025.

- The first €16,320 are taxed at 25%.

- The part between €16,320 and €28,800 is taxed at 40%.

- The part between €28,800 and €40,000 is taxed at 45%.

- At the end, the tax-free allowance of €10,910 is taken into account, reducing the final tax due.

The result is that you pay significantly less than 45% tax on average, because the first part of your income is taxed at a lower rate.

The tax-free allowance can therefore be seen as a kind of discount. If we calculate the total, we end up with: €14,112 − €2,727.50 = €11,384.50

This means you pay approximately €11,384.50 in personal income tax on €40,000 of taxable income. This amounts to an average tax burden of around 28.5%.

Of course, every situation is different. For example, do you have dependent children? If so, the tax burden will be even lower.

Useful tool!

Use this gross-net calculator to easily calculate your taxes.

What changes in 2027?

The rates themselves (25%, 40%, 45%, 50%) have been stable for some time. The income thresholds change slightly every year, though. Both the brackets and the tax-free allowance are indexed to follow inflation.

What else determines how much tax you pay?

The tax brackets are only part of the picture. The final amount you pay also depends on several other elements.

- The municipality where you live (which charges municipal tax on top of federal tax)

- Deductions such as pension savings, donations or a mortgage loan

- Your family situation, since more dependants mean less tax

Tips to reduce your taxes

💡Some simple ways to be smarter about your taxes:

- Check your tax-free allowance

Make sure all increases are correctly applied, such as those for dependent children or single parent status. - Use your deductions

Pension savings, childcare costs, donations and energy saving investments all reduce your tax burden. - Make timely advance payments as a self-employed person

This helps avoid a tax increase. - Plan ahead

Certain expenses made before 31 December can make a difference in next year’s tax return, especially if your income is higher than expected. - Keep your receipts well organized

Add all your expenses in Dexxter. More costs mean less profit. Less profit means a lower taxable income.