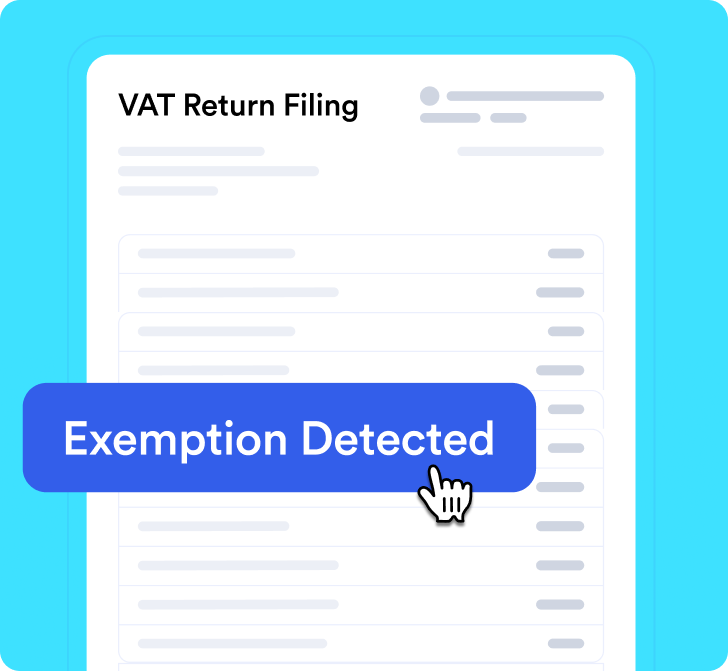

Peppol deadline: 01-01-2026

00

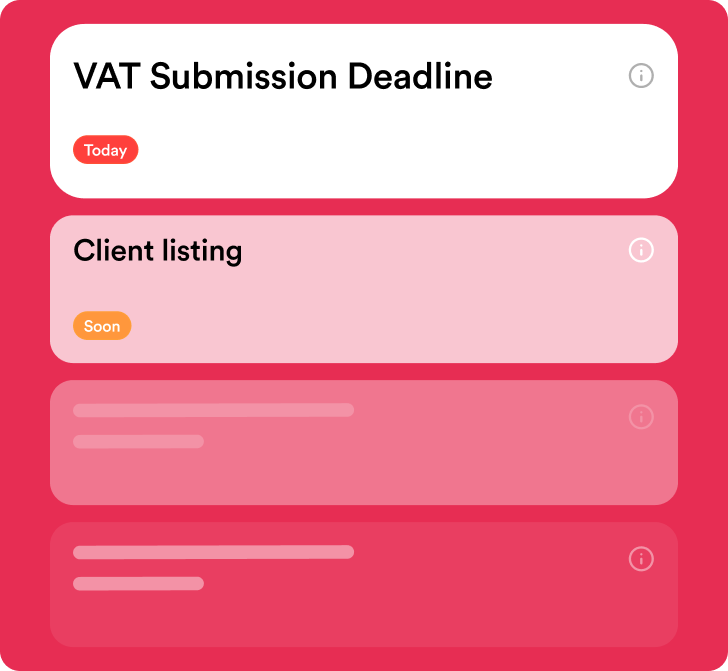

Avoid fines

- The platform

Hey, I’m Giel. I will briefly show you our platform.Meet Dexxter in 10 minutes

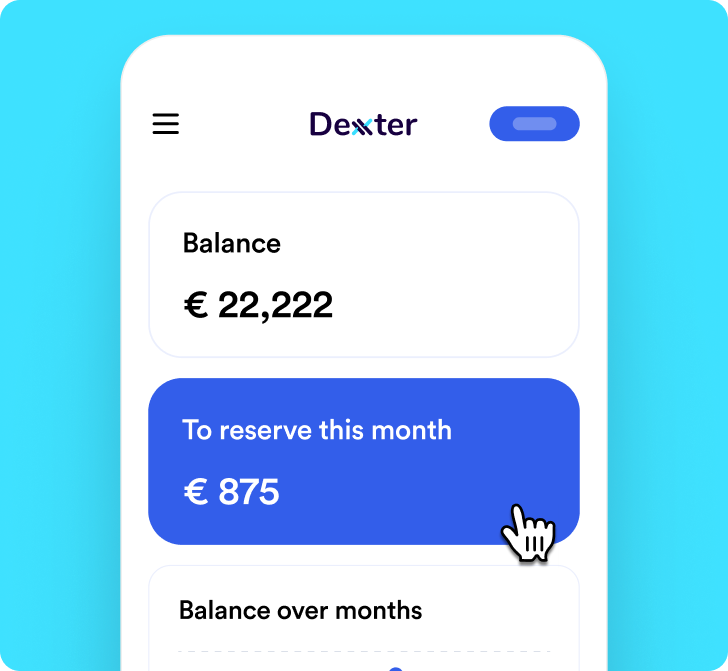

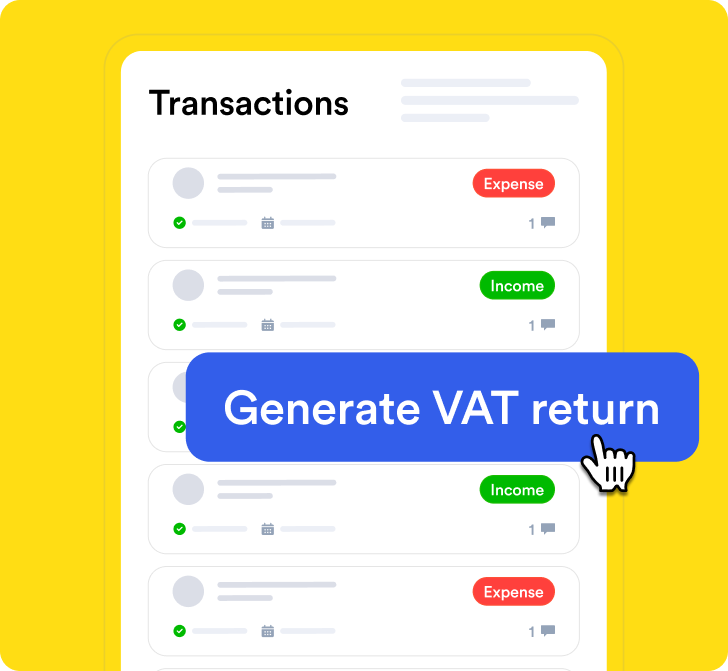

Hey, I’m Giel. I will briefly show you our platform.Meet Dexxter in 10 minutesOur platform has all the tools you need to do your accounting yourself.

The Platform

The accounting platform for Belgian sole proprietorships 🇧🇪

- For who

Hey, I’m Giel. I will briefly show you our platform.Meet Dexxter in 10 minutes

Hey, I’m Giel. I will briefly show you our platform.Meet Dexxter in 10 minutesOur platform has all the tools you need to do your accounting yourself.

For who

Specifically for starters & sole proprietorships like you 🧐

For accountants

For starters

Stories

- Pricing

- Blog

Useful links

All about accounting for sole proprietorship 🧠

Follow our webinars every week on self-bookkeeping.Every week we orgnaize webinar on on self-bookkeeping specifically for your status.

Follow our webinars every week on self-bookkeeping.Every week we orgnaize webinar on on self-bookkeeping specifically for your status. - Vibe

- The platform

Hey, I’m Giel. I will briefly show you our platform.Meet Dexxter in 10 minutes

Hey, I’m Giel. I will briefly show you our platform.Meet Dexxter in 10 minutesOur platform has all the tools you need to do your accounting yourself.

The Platform

The accounting platform for Belgian sole proprietorships 🇧🇪

- For who

Hey, I’m Giel. I will briefly show you our platform.Meet Dexxter in 10 minutes

Hey, I’m Giel. I will briefly show you our platform.Meet Dexxter in 10 minutesOur platform has all the tools you need to do your accounting yourself.

For who

Specifically for starters & sole proprietorships like you 🧐

For accountants

For starters

Stories

- Pricing

- Blog

Useful links

All about accounting for sole proprietorship 🧠

Follow our webinars every week on self-bookkeeping.Every week we orgnaize webinar on on self-bookkeeping specifically for your status.

Follow our webinars every week on self-bookkeeping.Every week we orgnaize webinar on on self-bookkeeping specifically for your status. - Vibe

Peppol deadline: 01-01-2026

00